When Visibility Goes, Optionality Rules

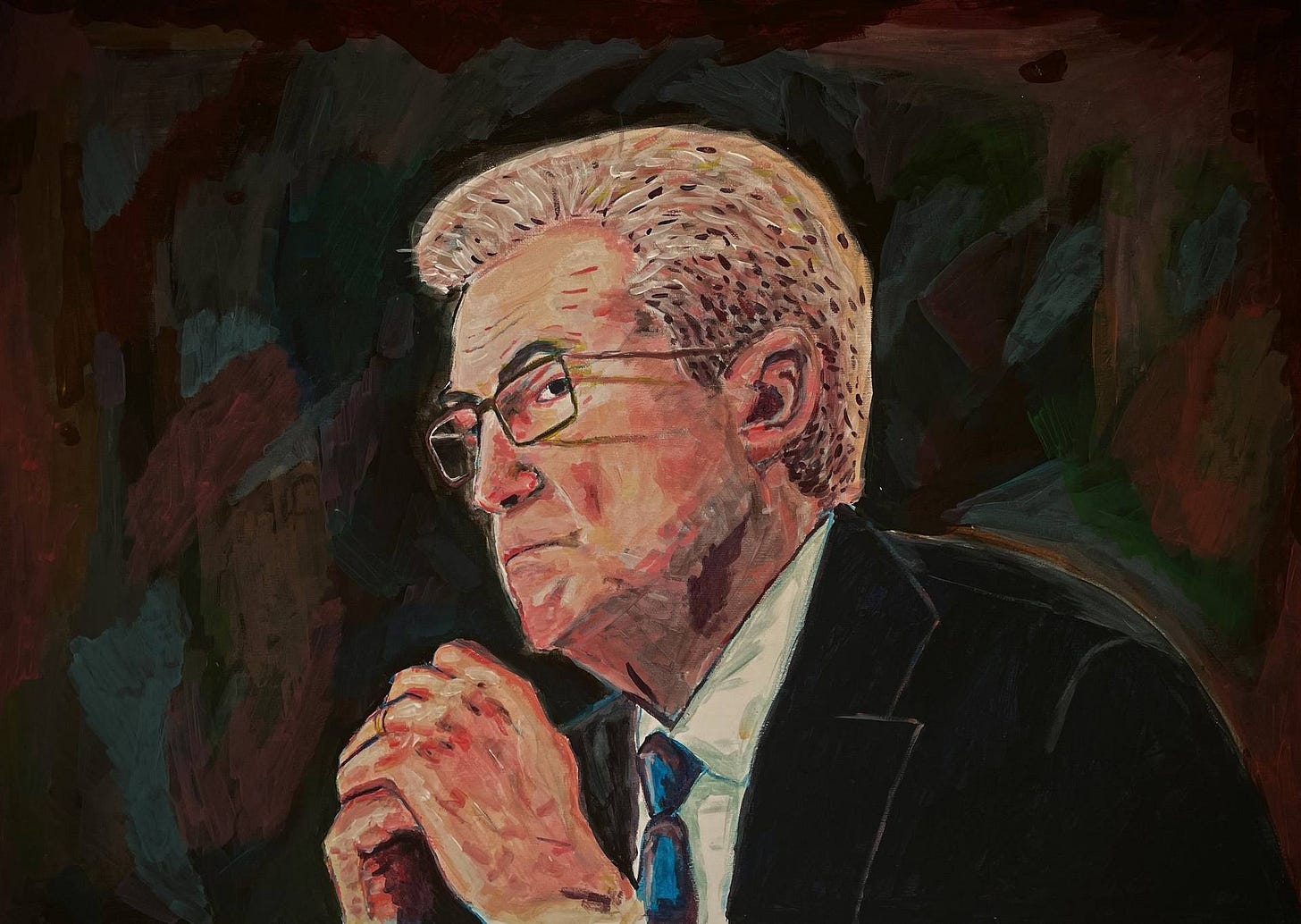

Powell is buying time and options while the data darkness continues.

Going into the week, the FOMC meeting felt like a foregone conclusion. No surprises. A 25bp cut was on the way, and the announcement of a QT end was expected (even if the exact timing was debatable). Most attention was on big tech earnings.

However, markets were caught off guard by Powell’s tone. The key line was his pushback against the idea that another cut in December is “a foregone conclusion.” In fact, “far from it.”

Maintaining optionality is a standard feature of any Fed press conference. But in past meetings, Powell leaned on “data-dependence” as the rationale. This time, the tone was more deliberate and less accommodating than markets had priced.

A rate rethink followed. December cut odds are now around 62% on Bloomberg’s WIRP, down from near certainty earlier in the week. The terminal rate has edged higher, with the path now implying a higher plateau.

The longer the shutdown drags, the blinder the Fed becomes. Without new data, confidence in the outlook erodes, and with it, the willingness to act decisively. Powell’s pushback felt less hawkish than strategic: a move to preserve room for December rather than commit into a data vacuum. It’s easier to manage expectations from a balanced market than from one fully priced for easing. By tempering assumptions now, Powell buys time. Flexibility matters more when visibility collapses.

If I had to place my bets now, we still get a quarter-point reduction in December.

The underlying dynamics haven’t shifted enough to derail it. Inflation is running a touch warmer than the old regime would tolerate, but the Fed shifted to Average Inflation Targeting (AIT) and now aims for inflation to average 2% over time, rather than a fixed goal. That gives policymakers room to look through near-term stickiness.

The labour story remains the real driver. Rhetoric at Jackson Hole and the last meeting was centred on emerging softness, and although we’re in a data blackout for now, there’s little reason to assume that picture has meaningfully improved. A slowing labour market has been the justification to cut in the past two meetings, and it’s unlikely that will change between now and December. The Fed still remembers the lesson of 2024: wait too long, and you end up cutting under pressure, not on your own terms.

However, when the lights are figuratively back on for data within the US, the picture will become much clearer, and markets will be quick to adjust in one direction or the other.

Time for my coffee,

J