Markets Are Learning to Live With Rearmament

“Defence is the best secular equity theme … everywhere.”

If 2025 was a milestone year of returns for European defence, 2026 looks like an early contender to challenge feat.

As BofA’s Hartnett put it earlier this week: “Defence is the best secular equity theme … everywhere.”

The key differential this year to last year is the global nature. Not just is it Europe with double digit gains early doors, US names are thriving of Trump’s latest gear change to offensive geopolitical talk, and Asian defence is seeing several tailwinds, that of increased orders from the Middle East and new economic stances, such as that out of Japan.

The other key driver is the nature of this spending. The Russia-Ukraine war highlighted the modern day approach to war. Call it “War From Home.” Unmanned systems and tech is the focal point now. And most nations military is not setup to thrive in this environment. That leads the big players to pursue private acquisitions and joint ventures.

We’re also seeing an enthusiasm that is encouraging the defence IPO market. Armored vehicle and munitions maker Czechoslovak Group AS, owned by billionaire Michal Strnad, is considering launching an initial public offering in Amsterdam as soon as next week.

Alongside this optimism for defence investors sits a familiar risk. H1 2025 had a similar move higher after Trump pressured NATO to put less reliance on Uncle Sam. Markets rewarded the promises of increased spending, much the same as we are seeing now (even if this reasons for this spending may be different this time). But H2 2025 was a period of less excitement, a market not willing to reward the theme further but also not turning over completely. Earnings were behind that. Investors were sidelined, waiting to see the budget splurges show up on the bottom line.

Will we see the same outcome this year? Very likely. This is a theme that will find its juice from budget spending matching geopolitical tensions higher. When things cool off on the news front, so does this trade.

However, I caveat the prior point with this: I think the “cooling off” is directly tied to Trump, not Ukraine.

2026’s push (especially on Europe) hasn’t been linked to any developments in Ukraine. Trump’s snatching of Maduro really opened the possibilities about what buttons Trump is willing to press, how hard, and how many at once.

Already, we’re seeing focus on Greenland, as I wrote about last week. I wish this were a joke, but the below is an actual X post from the White House, jokingly “monitoring the situation.”

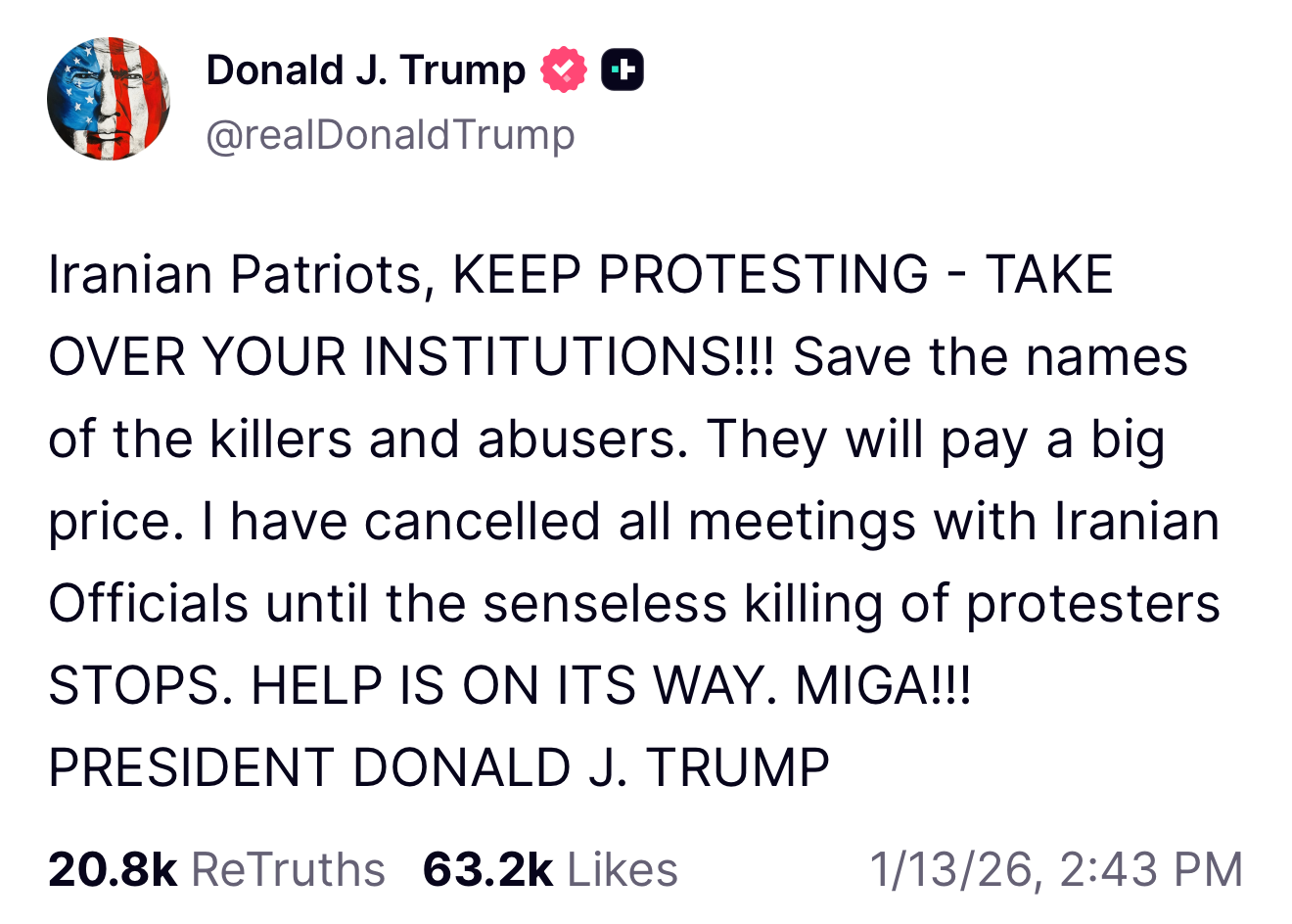

This week’s antics focus on Iran. Over on Truth Social, Trump has this to say:

As long as the antics continue, global defence will have to continue to rearm, with market beneficiaries across all corners, regardless of what happens in Ukraine.

Another area of concern comes from budgets being touted around. France has struggled to hold any form of government in recent years. The UK has quite a public budget problem, with the head of the UK’s armed forces warning yesterday that he’s anticipated cuts to military spending.

Germany, on the other hand, is doing exactly what NATO agreed. Spending, spending, spending. The release of the “debt brake” (Schuldenbremse) is partly behind that, an old rule that limited Germany’s deficit to just 0.35% of GDP (something the US could only comprehend in dream state). It also removes borrowing limits for defence spending above 1% of GDP, and creates a €500 billion special fund for infrastructure and climate investments, financed by new borrowing… but mostly for infrastructure.

Even as NATO applauds Berlin’s expanding military footprint, the mood in parts of Europe is more ambivalent. The return of a more assertive Bundeswehr is being watched closely, not just because of what it means for the continent’s balance of power, but because Germany’s domestic politics are shifting at the same time. A far-right, nationalist party is now polling at record highs, reviving a question many Europeans thought had been settled: whether a reliably pro-European government in Berlin can still be assumed.

But maybe that’s a story for another day.

Time for my coffee.

J